Risk insights and credit control make getting paid on time easy. Flexible finance gives you access to cash when you need it.

Evaluate the risk level of new and existing customers with a suite of risk analysis tools. View customers’ risk band, average payment time and suggested credit limit before deciding to work with them.

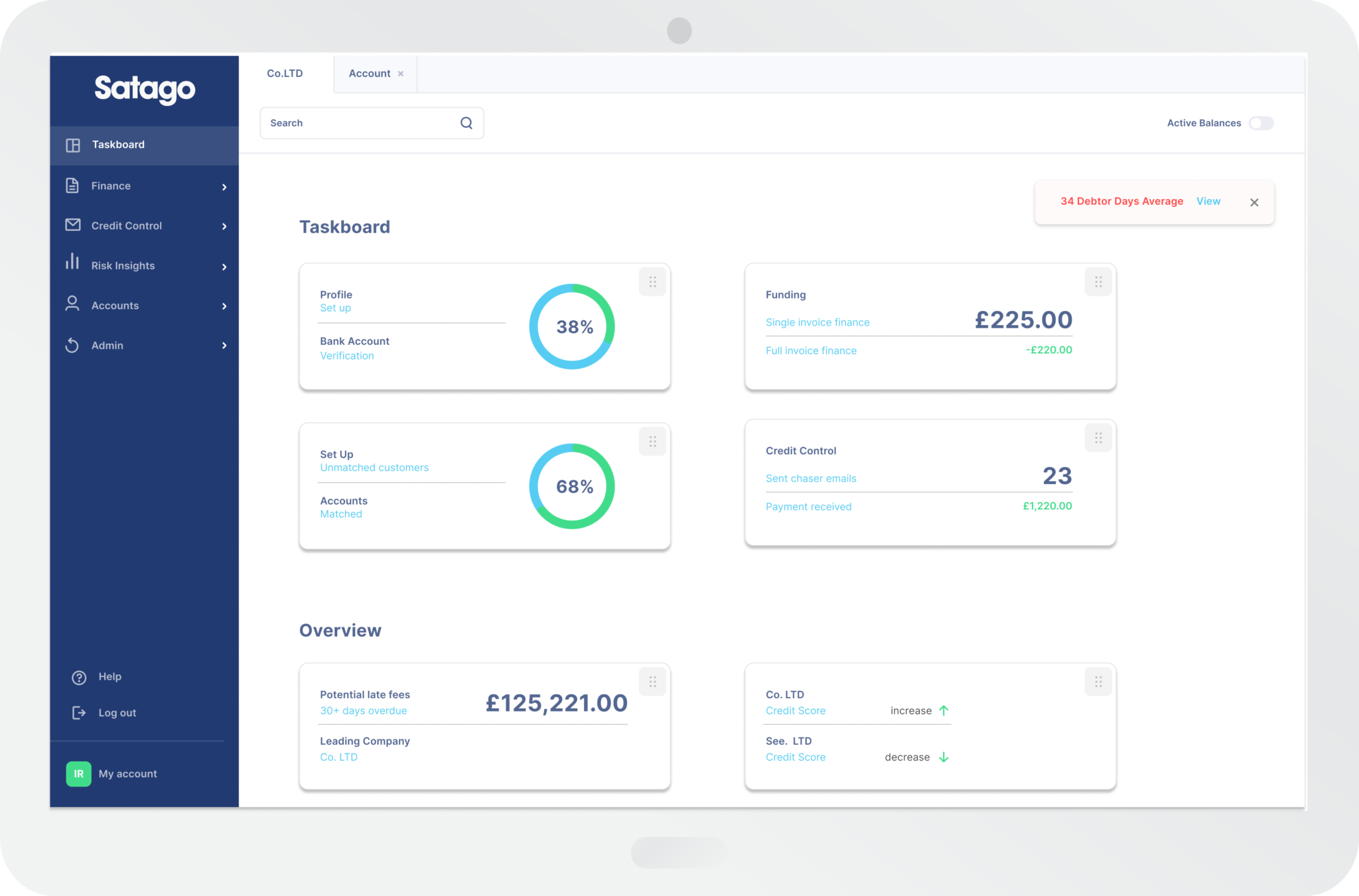

Automate your invoice reminders, monthly statements and thank-you emails. Customise the messaging and sending schedule for each client to build and maintain good relationships and even better payment habits.

Need to cover an unexpected bill or a large stock order? Get a fast cash advance using single invoice finance, all within the Satago platform. Finance one or multiple invoices, with clear pricing and no minimum commitment.

Set custom alerts and get notified when a client’s credit score changes, a payment becomes overdue or an invoice becomes eligible for finance. Store notes on individual clients so you’re always up-to-date.

Whatever accounting package you use, Satago is always in sync and up-to-date.