We put your clients’ debtor data at your fingertips so you can deliver a premium credit control advisory service.

The ultimate credit control service guide for accountants and bookkeepers

Satago’s Credit Control Service Handbook is everything you need to set up a credit control solution that delivers the best results for your clients.

This guide will show you how to:

Will Farnell

Farnell Clarke Limited

Rowan Van Tromp

App Advisory Plus

Complete the form below to download our CCaaS Handbook and help your clients today:

Your information will be used to send you a copy of the Improving Cashflow Playbook and subscribe you to our monthly newsletter. You can unsubscribe at any time. View our Privacy & Data Protection Policy for more information.

Satago shows your clients’ debtor data in a single view, allowing you to:

Armed with this information, you can provide your clients with actionable insight and help them improve their financial health.

Many businesses don’t have the time to put best practice credit control processes in place and pay the price in late payments. Switch on automated payment reminders for your clients and help them:

Credit checking is fundamental to avoiding late payments. Satago provides unlimited credit summaries and credit reports so you can help clients:

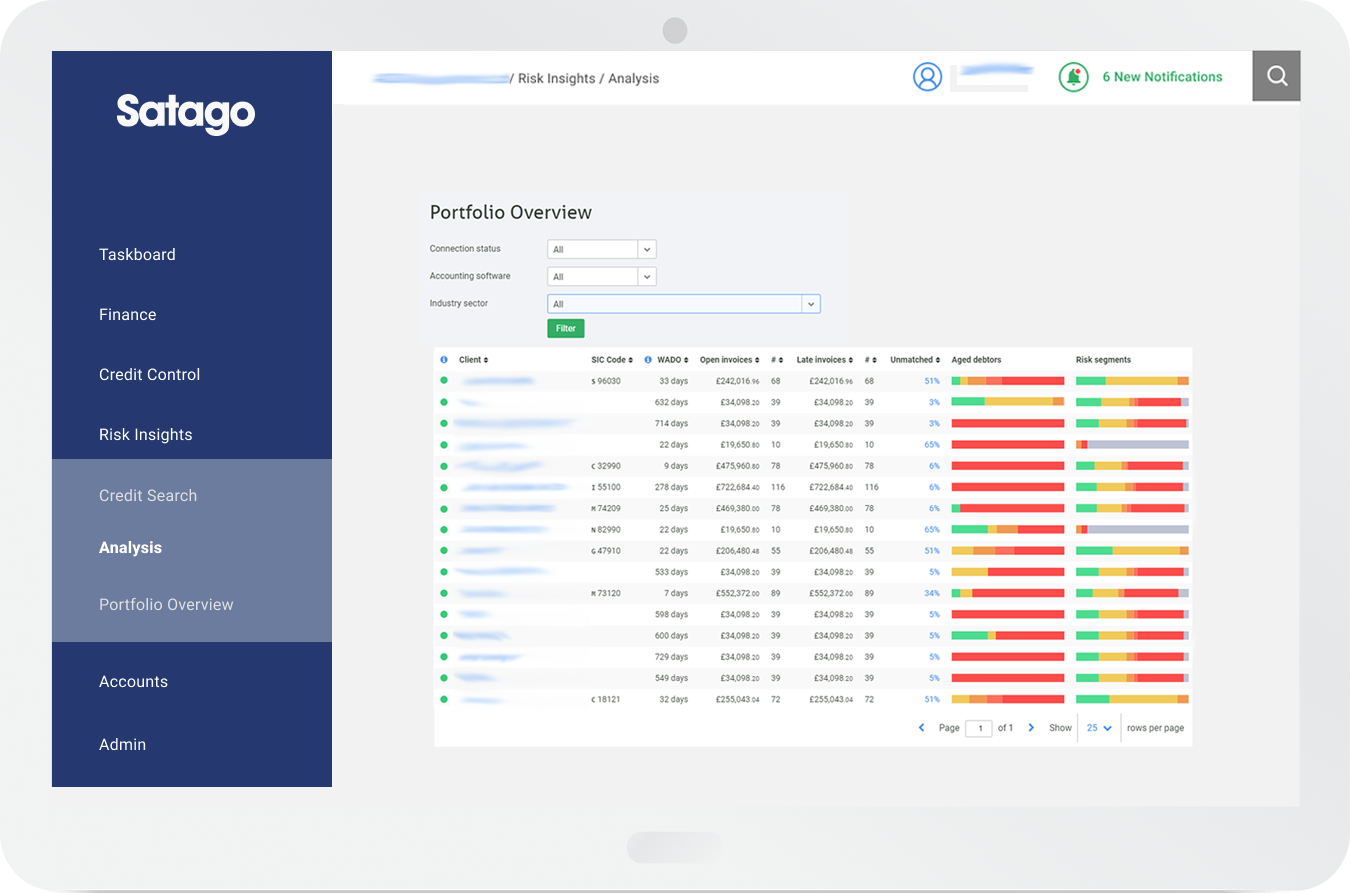

Once you have connected your clients to Satago (for FREE), they will appear in your portfolio overview. This will give you insights into their debtor book, and show you risk band distribution of their clients and their clients’ average payment days.

Using this information in the portfolio overview, you can easily identify which of your customers could benefit from your credit control as a service offering.

Read more about using our portfolio overview toolBy combing the power of our portfolio overview tool and our free credit control as a service guide, you can help your customers and grow your practice by adding a new credit control function to your offering.

I think it almost doubled her fee overnight the amount of work we were doing for her, so we were very happy with that again, she got her money quicker, so she was very happy to pay it – Daniel Edwards, d&k Accounting

Watch the full case study here