Late Payment Fee Calculator: How to Charge for Overdue Invoices

As a small business, there are a few reasons you might be looking for a late payment fee calculator:

- You’re using late payment fees to encourage your customers to pay more quickly and therefore reduce debtor days.

- You’ve currently got a few clients who are very overdue on their invoices, and are using late payment fees as a last resort.

- You charge late payment fees regularly but need to manually calculate them each time.

Many small businesses don’t realise that they can charge their customers late payment fees, and they are an underused way to get paid more quickly. In fact, you don’t even have to put it in your terms or conditions or your contract, it’s a statutory right and the law in the UK.

However, if you are going to charge late payment fees, you often have to calculate them yourself since it’s a calculation that involves breaking down an annual interest rate into a specific number of days. This can get complicated, especially when you’re accepting part payments.

The other issue is that most accounting packages don’t offer late payment fees on their invoices, so you’re stuck doing this manually.

Scroll down to use our late payment fee calculator, and then keep reading if you want to find out how to automatically add late payment fees to your invoice reminders.

Note: looking to automate your late payment fee calculations and add them to your invoice reminders? Get started immediately with a 14 day trial of Satago.

Calculator: How to calculate late payment fees

Free late payment calculator

Daily interest charge

Compensation

Total late fees to date

Late payment fees are essentially interest charges on a debt. You can charge your customers late fees as soon as an invoice passes its due date. If you did not agree to a due date with your customer, the invoice is considered overdue 30 days after it was issued.

In the UK, late payment fees are calculated as follows:

- Calculate the annual statutory interest on the debt, which is 8% of the invoice amount plus the Bank of England’s base rate. The Bank of England base rate is subject to change, so the amount of interest you can charge will depend on the due date of your invoice.

- To calculate the daily late payment fee on an invoice, take the annual statutory interest and divide it by 365.

- In addition to the daily fee, you can charge a one-off fixed compensation fee, which changes depending on the size of the invoice: £40 for a debt less than £1000; £70 for a debt between £1000 and £10,000; and £100 for a debt of £10,000 or more.

- To work out the total fees; multiply the daily late payment fee by the number of days the invoice is overdue and add the compensation fee.

Total fees = daily late payment fee x days overdue + compensation fee

How to use late payment fees to get paid more quickly

As a small business, it’s easy to feel powerless when you’re requesting payment from large organisations. According to Simply Business, it is estimated that more than £23.4 billion is owed to UK businesses. Late payment fees are one way to gain back a little part of that power. Here’s how to use late payment fees to get paid more quickly.

Let your customer know that you will charge late payment fees

Before sending over an invoice with your late payment fees, you want to make sure it’s clear you’re going to start charging late payment fees. That’s because sending an invoice out of the blue with an additional charge might negatively affect your relationship with the customer.

One example is to send a couple of warnings a week before you plan to start charging late payment fees. On one of your reminder invoices, you can add a sentence along the lines of:

“We have the right to charge interest on late payments. We won’t add any additional fees if you pay before [X] date.”

Often, a few warnings are enough to encourage the client to pay.

Note: at Satago, you can use “snippets” that will automatically calculate the late payment fee. Scroll down to read more on how to do this.

Send another reminder with the new invoice

If a week passes and they still haven’t paid, you can then send a reminder and explain that you’re sending a new invoice with the late payment fee.

If you’re doing this manually, you can use a late payment interest calculator like the one above, and manually calculate how much they should pay. Then, send them a new invoice with the new amount. Remember, you have to keep sending invoices as the days go on.

What do I do if my customer doesn’t pay their invoice?

Although late payments are frustratingly common, non-payment is rare. There are steps you can take to recover payment from customers who fail to respond to your payment reminders, including mediation and legal action via debt collection and debt recovery (you can read more about this here), although this should be a last resort.

The best way to recover debts is through effective credit control and communication with your customer.

Read more: What to do with overdue invoices and two ways to prevent late payments

How to automate late payment fees with Satago

The method above works well to encourage people to pay, however if you’re dealing with lots of invoices and clients it can get confusing, messy and chaotic very quickly. We built Satago to help SMEs automate a large part of chasing invoices and getting paid.

Here’s how to automate the process above with Satago:

1. Sign up to Satago’s 14 day free trial and integrate with your accounting tool.

2. Head to settings and turn on late payment fees.

3. Once your synced up with your accounting package, head to the list of your invoices at “Accounts Receivables” and you’ll be able to see at a glance how much you can charge in fees for each late payment.

4. Build a workflow to add late payment fees to invoice reminders:

a. Head to your invoice reminder templates

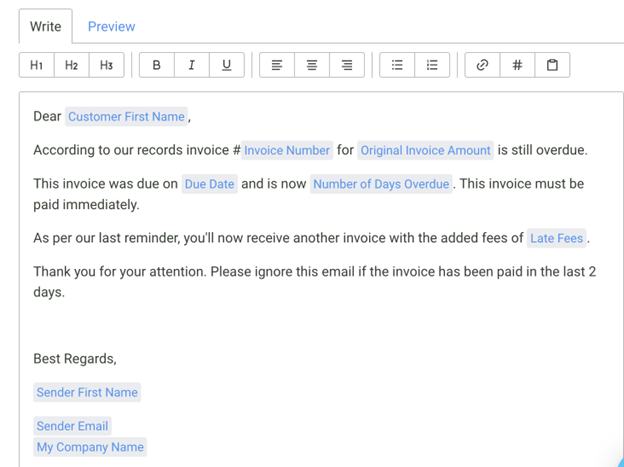

b. Set up multiple invoice reminders at certain overdue days. For example, at invoice reminder 3 when you’re already 20 days overdue, add a sentence along the lines of: “We reserve the right to charge statutory interest of [X – Satago will add this number automatically] if the payment is not received in the next seven days”

i. You’ll be able to use Satago snippets to include invoice dates, amounts and total late payment interest.

c. Set up another reminder – in this case, reminder 4 – where you include something like “As per our previous invoice reminder, since we haven’t received payment you will now receive an invoice for this amount of interest of [X]”

d. You can then copy yourself into this last email, so that when reminder 4 is automatically sent, you’ll also get it in your inbox. This will be a reminder for you to go create a new invoice and send it to them.

If you’re a Satago customer, you can add late fees to your invoice payment reminders automatically. The platform will calculate the fees for you in line with statutory limits and add them to your automated payment reminders as soon as an invoice becomes overdue.

At Satago, we encourage SMEs to use late payment fees and credit control tools as they are the best way to ensure you get paid on time. If you don’t use these types of tools, you’ll always have to continuously chase invoices. We believe a behaviour change is what’s needed to get large companies to pay on time.

What else can you do with Satago?

Interested in what else Satago offers?

Satago is a cash flow management tool that offers invoice financing and credit control. With Satago, you’ll be able to see at a glance how late your customers are paying, send as many invoice reminders as you like and if everything fails you can use invoice financing and get 90% of your invoice upfront.

Here are some of the key Satago features you might be interested in:

Customise invoice template reminders exactly as you want them

You’re likely using an accounting tool like Xero or Quickbooks already. Although you can already set up automatic invoice reminders with these tools, their functionality is a little limited.

What if you want to send a reminder before the due date of payment so the client is ready to pay? What if you want to send them a thank you email when they pay early? What if you want to add custom text for certain industries and customers?

With Satago, you can customise your invoice reminders as much as you want. You can do grouped invoice reminders (sending an email with multiple invoices, rather than bombarding the customers with separate invoice emails). You can set up custom invoices that will automatically add late payment fee information, so you don’t have to calculate it manually. You can also set up different invoice reminder templates for different types of customers, or different industries.

Learn more about our credit control tool.

See how creditworthy your clients are

What if you could know in advance whether a client would cause issues when paying and therefore give them shorter payment terms?

We’ve partnered with a credit reference agency and through our Risk Insights tool, you can quickly see how creditworthy a client is.

Not just that, but because Risk Insights also syncs with your Xero, which means it’ll also tell you how long clients take to pay you on average and which clients could be causing issues.

Get started with invoice financing

If you’re looking to get your payment as quickly as possible, one other option is invoice financing where you essentially get an advance on your unpaid invoices.

Whereas most other invoice financing tools will only allow you to do full invoice financing (meaning you’re locked in for 12 months and have to do invoice financing for every single customer), we give you the option to choose between single and full invoice financing.

That means that with Satago, you have the option to only request an advance on specific invoices whenever you need to.

Not just that, but a lot of invoice financing tools will charge you an arrangement fee, a monthly service fee and an interest fee – as well as additional hidden fees such as bank charges, report charges and refactoring fees.

At Satago, we only charge an arrangement fee, services fee, interest and that’s all. We’ve focused a lot on keeping our pricing transparent and simple.

Another key benefit is that since we’re integrated with your accounting packages, you won’t have to upload and submit PDFs: it can all be done with a few clicks from your dashboard.

Satago is an easy way to get started with invoice financing.

Read more about our invoice financing options.

With late payment fees, you’ll hopefully be able to encourage customers to pay faster and reduce your debtor days. If you’re keen to include late payment fees in your processes, then automating it with a tool like Satago is one of the easiest ways to get started. If that’s you, join our 14 day free trial and see for yourself!