How to calculate Days Beyond Terms (DBT)

Most people know what a credit score is and how it impacts their business. But not everyone knows how credit scores are calculated.

Days Beyond Terms (DBT) are a measurement of how often a business pays its suppliers late. Credit bureaus use DBT when calculating a business’ creditworthiness. Businesses with a high DBT average may find it harder to negotiate long credit terms and access finance.

If your business acquires a customer with a high DBT average, it means they’re not paying their bills on time. To protect your business from the sting of late payments and bad debt, you should consider putting them on short payment terms or even refusing them credit altogether.

The best way to find out your customers’ DBT average is by running a credit check.

If you’re a Satago customer, you can credit check your customers within the platform and instantly discover their DBT average.

Days Beyond Terms formula

If you’re interested in learning your own DBT average, you can calculate it quite easily. All you need is:

1) The value of the invoices your business paid during the period you are measuring.

2) The due date of each invoice.

3) The date your business paid each invoice.

The formula for calculating DBT average is:

DBT = [SUM (invoice values x days in arrears)] / [SUM (invoice values)]

For invoices that are paid early, you can use a negative ‘days in arrears’ figure. For invoices that are paid on time, the days in arrears will be 0.

Example

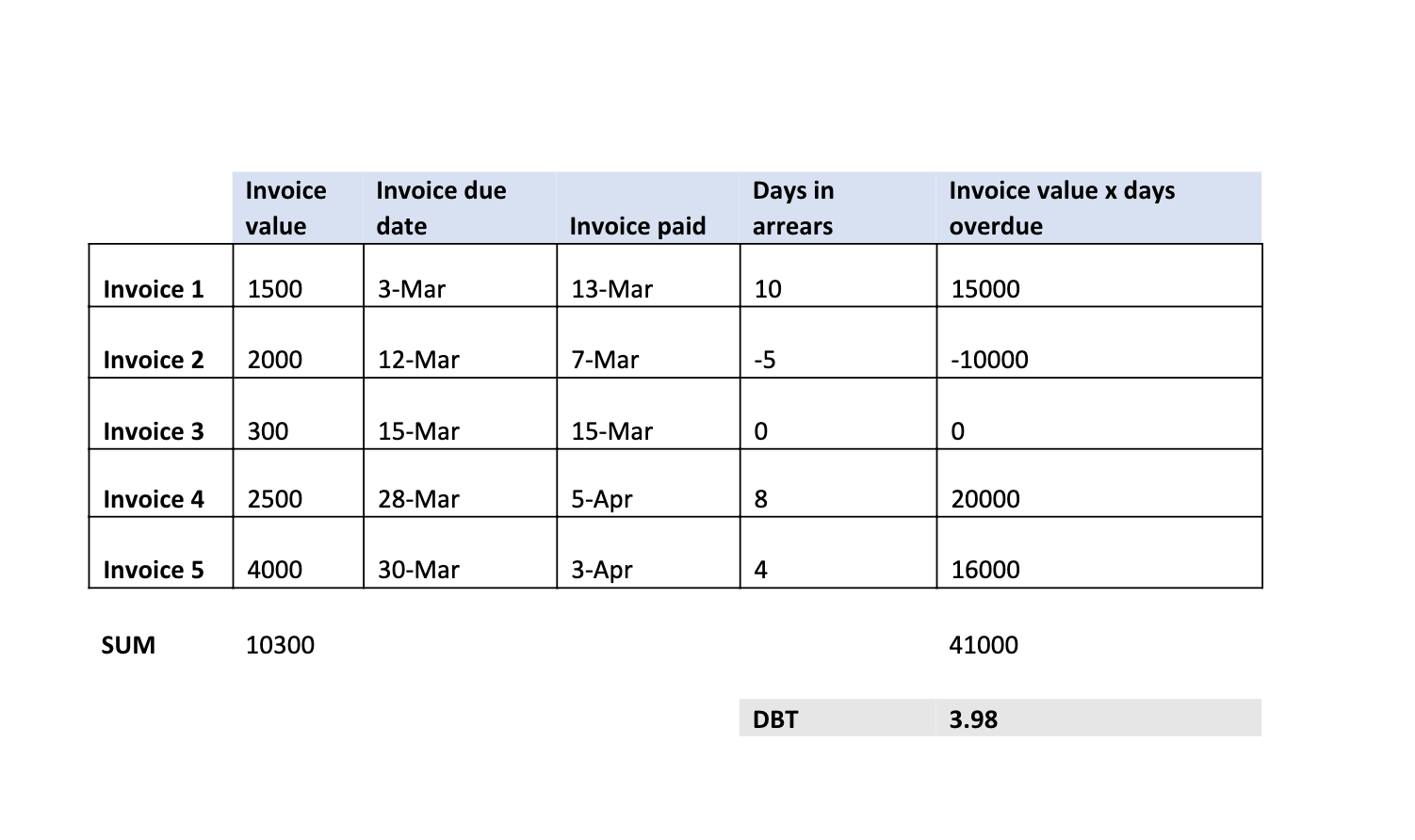

A company wants to measure their average DBT for March. Their March invoices are listed in the table below. To work out their average DBT they:

1) Sum the invoice values for the month. In this instance the total value is £10,300.

2) Multiply each invoice value by the number of days the invoice was in arrears and sum the resulting values. In this example, the resulting number is 41,000.

3) Divide this number by the total invoice values: 41,000/10,300.

Their average DBT for March is 3.98.

Why are Days Beyond Terms important?

You should keep your DBT average low in order to maintain a healthy credit score. Additionally, keeping an eye on your customers’ DBT average will help protect your business from late and non-payment.

Late payments cause 50,000 UK businesses to close each year according to the Federation of Small Businesses (FSB). So, it pays to stay informed about your customers’ credit score.

Average Days Beyond Terms by industry

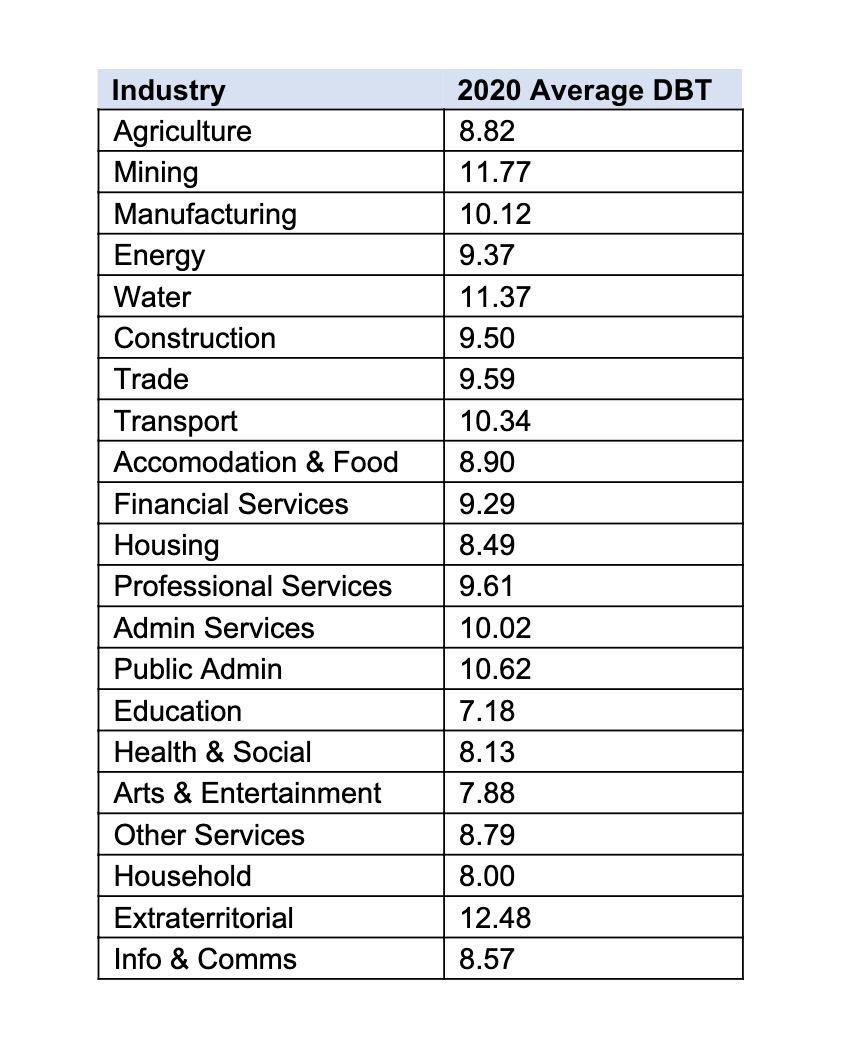

DBT average varies by industry. To find out how your business stacks up, you should measure your DBT against the average in your sector. Similarly, you can measure your customers’ DBT against the average in their sector.

Remember, DBT indicates how often invoices are paid late. So, a company that is put on short payment terms could have a higher DBT average than a company that is put on longer payment terms, even if they pay their invoices faster.

Here is the average DBT by industry for 2020.

Scenarios where DBT average is useful

1) Applying for finance: it’s important to know your DBT average before you apply for finance, as it may affect the interest rate you are offered.

2) Improving your processes: if your business often pays its suppliers late, think about why. Do you struggle with cashflow? If so, what can you do to improve?

3) Deciding a customer’s credit terms: if your new customer often pays suppliers late, you should think twice about putting them on generous credit terms. Checking their DBT average is a good way to determine their payment practices.

4) Applying for invoice finance: if you’ve decided to free up cash from your unpaid invoices using invoice finance, you should check your customers’ credit score and DBT to ensure there’s no risk of late payment.

To learn more about Satago’s credit checking and cash management software, sign up to the platform or book a demo with our team.