Debtor Days Calculator: How to Reduce the Time it Takes to Get Paid

If you’re doing research on debtor days, you might be:

- Dealing with a high number of debtor days, which has an impact on your cash flow.

- Trying to understand what is the average number of days your clients take to pay you.

- Looking for ways to get paid more quickly.

Understanding how long people take to pay you is a good way to look at the health of your business.

In this article, we’ll explain what debtor days are, how to calculate them and what you can do to reduce them. You can also use our calculator below to work out your debtor days quickly and easily.

Note: looking for a fast way to reduce debtor days? Satago’s Credit Control tool allows you to automate invoice payment reminders, automatically add late payments fees and reduce debtor days by up to 72%. Sign up now to get started!

Debtor days

Debtor days are a measurement of the average amount of time it takes your customers to pay you. Debtor days are sometimes called ‘days sales outstanding’ or DSO.

If your company has a large number of debtor days, it can put pressure on your cash flow, meaning you have less cash to invest in growing and running your business.

The fewer your debtor days, the faster you’re getting paid and the more cash you have to spend on scaling your business.

Your debtor day ratio is calculated periodically on a monthly, quarterly or yearly basis. You can only calculate your debtor days for a period once that period has come to an end.

For example, if you want to calculate your debtor days for December, wait until 1st January to make your calculation. Then follow these steps:

- Calculate your accounts receivables (also called trade receivables) — this is the total amount of money owed to you by your customers.

- Calculate your total credit sales for the period — this is the amount of money you have invoiced your customers for during this period, this number is sometimes called your ‘gross sales’.

- Divide your accounts receivables by your total credit sales and multiply by the number of days in that period.

So, if you are calculating your annual debtor days the debtor days formula looks like this:

(Accounts receivables ÷ credit sales) x 365 = debtor days.

Read more: How to calculate debtor days in Xero, Sage, Quickbooks and FreeAgent

What is a good number of debtor days?

Debtor days can vary by industry, so it’s best to check how your debtor days measure up to the standard in your sector in order to gauge whether your collections process is working efficiently. Generally speaking, you should aim to keep your debtor days under 45.

Data suggests that debtor days have been rising in recent years across many industries, a worrying trend that could be leading more businesses to become insolvent.

How to decrease the number of debtor days

Having a high number of debtor days can seriously impact cash flow.

Think about this: for every £100,000 of turnover, an increase of 1 debtor day equals £270 leaving your bank account. So if someone is 10 days late, that’s £2,700 that’s not in your bank account – which is no small amount. Getting paid more quickly helps keep that money in your account.

Not only that, but in 2023 things are getting harder for small businesses which means that more people are paying later. That’s why you want to make sure you have the processes in place to get paid as quickly as possible.

Here are a few ways to do that:

1. Be upfront and clear with your customer about payment

The first step to getting paid more quickly before sending any invoices or reminders, is to have a discussion with your customers about payment.

That means being upfront and clear with your customers about the payment process, about when billing takes place, what stage of the job you’re at and what the payment terms are.

Most people don’t pay late for dishonest reasons: most don’t pay because they forget about processing an invoice or didn’t expect it.

Being very clear about how you’re going to invoice can go a long way in getting paid more quickly.

2. Invoice as quickly as you can (and use automation!)

If you expect your customer to act quickly, then you need to be quick as well. That means, be quick in issuing invoices. If you invoice three weeks late, the client might take that as “it’s not important” and therefore that it’s fine if they pay late.

The best way to ensure you invoice quickly is to set up automatic invoicing through your accounting package like Xero or Sage. You can set up automation to send through an invoice once a month, or you can even set up an invoice for a future date.

3. Set up an invoice reminder workflow

Based on the customers using the Satago platform, we know that about 70% of invoices are paid after the first invoice reminder and 86% are paid after the second automatic reminder.

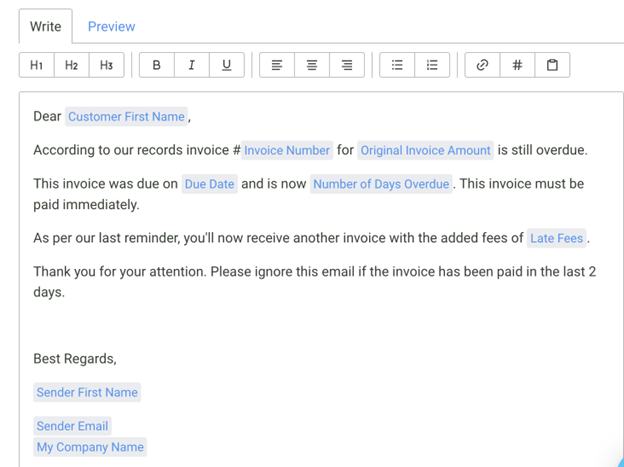

Never underestimate the power of cohesive invoice reminder workflow – ideally one that is very customisable.

For example, you could send a reminder before the payment is due, to make sure they’re ready to pay. You can also send a reminder multiple days after payment is due. If payment still hasn’t been received, start charging late payment fees to incentivise them to pay more quickly (but make sure you warn them beforehand).

With Satago, you can customise your invoice reminders and workflows as much as you want. You can send:

- Reminders before payment is due.

- “Thank you for early payment” emails.

- Late payment fees (automatically calculated) reminders.

- Grouped invoice reminders (instead of sending separate email reminders).

If you have a credit controller on staff, a tool like Satago will help them stay on top of debtor days and chase payments more efficiently.

4. Don’t invoice on the same day as everyone else

Many companies send their invoice at the end of the month with 30 day payment terms.

On the Satago platform we’ve seen a massive spike of reminders going out on the seventh day of the month because the default invoice reminder is seven days after the due date. From the purchaser’s point of view, it’s easy to imagine how overwhelming it can be to get so many invoices and reminders on the same day. It means it’s a lot more likely that your invoice will get lost.

Some larger companies also do payment runs – usually twice per month. If you miss a cutoff point for a payment run, then you have to wait another two weeks.

In order to overcome this, send an invoice as soon as your job is done so you stand out. The earlier you send your invoice, the sooner you’ll get paid.

You may like: How to calculate Weighted Average Days Overdue

5. Charge late payment interest

One way to incentivise faster payment is to charge late payment interest.

By statutory law in the UK, you are allowed to charge an annual rate of 8% of the invoice amount plus the Bank of England’s rate. This doesn’t have to be in your contract or in the terms and conditions: it’s the law.

If your client is not paying, you can warn them that you’ll start charging late payment interest and then send them an invoice with a new pricing that includes late payment fees.

However, this can get quite complicated as you have to manually calculate the late payment interest, then re-send a new invoice with the new fee. Include part-payments and multiple clients, and it can get very complicated.

With Satago, you can automate the entire process. Here’s how:

1. Sign up to Satago and integrate with your accounting tool

2. Turn on late payment fees in the settings tab

3. Once you’ve synced with your accounting package, head to “Account Receivables” and you’ll be able to see how much you can charge in late payment fees for each client.

4. You can then use invoice reminders and build a workflow that includes late payment fees:

a. Go to invoice reminder templates

b. Set up multiple invoice reminders. At one of the later reminders, add in a sentence that warns the customer that you will charge late payment fees if they don’t pay.

For example: “We reserve the right to charge statutory interest of [X – Satago will add this number automatically] if the payment is not received in the next seven days.”. Use Satago’s snippets so the late fee number automatically updates every time you send a reminder.

c. Set up another reminder which states that you will now send an invoice with the updated price.

d. Make sure to copy yourself in the last email, so that you get it in your inbox. This will act as a reminder for you to create a new invoice and send it to them.

Read more about late payment fees here: Late Payment Fee Calculator: How to Charge for Overdue Invoices

6. Use credit limits

You usually don’t know how fast a client pays until you start working with them. However, there are ways where you can avoid extreme late payors: with a credit search and report.

With Satago’s Risk Insights, you can limit the exposure to clients who don’t pay on time by completing a credit report before working with them. With this credit report, you can see how risky they are as a client and what their recommended credit limit is.

If this client reaches the recommended credit limit, you can then choose to stop doing work for them until they pay and therefore avoid going into debt collection.

Credit limits and reports give you more information about a customer and will allow you to make an educated commercial decision on whether to continue working with them. Getting intelligence and insights is one of the best things you can do to ensure you get paid quickly.

How this company reduced their average accounts receivable to 30 – 45 days

Daniel, founder of D&K Accounting, noticed that one of his SME clients had a high debtor of book, with £30,000 in outstanding invoices and some which were 9 months old.

He discovered Satago, and immediately went away to set up email reminders for his clients. As he says:

“We just linked it to QuickBooks and when invoices went past the basic due date, automated messages would go out. All communications and automated messages are in one place so it’s easy to keep track of what is going on.”

With Satago in place, he managed to help his client reduce his outstanding debtor book down to £1,500, with all outstanding invoices paid within 30 to 45 days.

Daniel says: “The client was really happy due to them getting a £30,000 cash injection. They used these funds to expand, take on more staff and new computers, as well as going on holiday and fun stuff too!”

That’s an example of how having the right email reminders in place can help decrease debtor days substantially.

Read more about their experience here: Client Case study – D&K Accounting – Satago

With harder times coming ahead of us, it’s more important than ever to focus on reducing your debtor days as quickly as possible. In order to get paid within 45 days, use invoice reminders, credit reports and late payment fees to encourage faster payment. If you’d like to do all of that within one tool, sign up to Satago’s 14 day trial to give it a go.